11. Scenario Analysis

11.1 Introduction

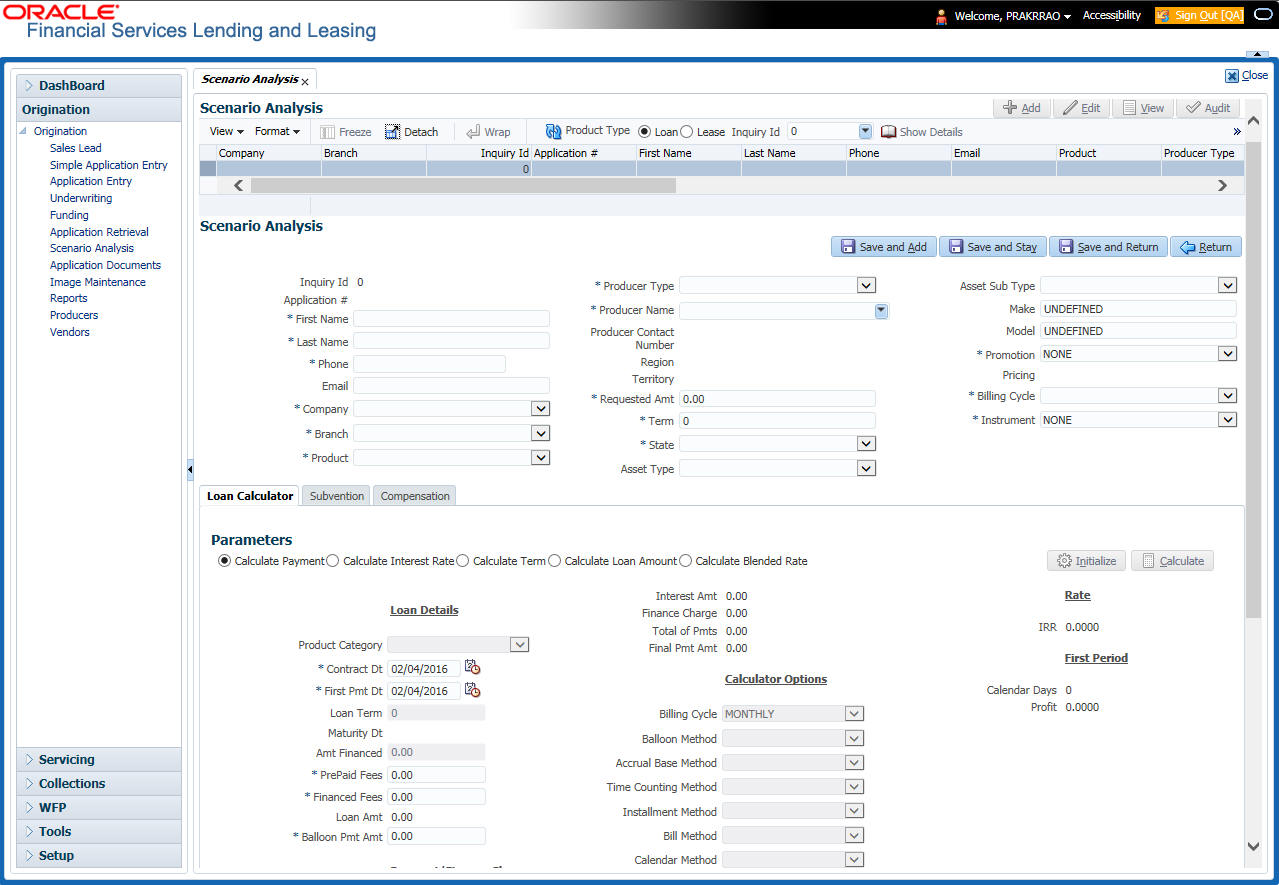

With the Scenario Analysis screen, you can simulate the customer’s Loan request Loan amount, rate and create a mock proposal in Loan with your lending policies.

You can use scenario analysis screen to complete the following tasks:

- View an Existing Scenario Analysis

- Generating Scenario Analysis

- Auto Suggest Pricing for the Scenario Analysis

- Creating an Amortized Schedule for the Scenario Analysis

- Creating an Application from the Scenario Analysis

- Generating a quote from the scenario analysis

Note

Depending on the product licensed, you can view either Loan or Lease Calculator details. If you have licensed both, then you are provided with an option in Scenario Analysis screen to select the required Product Type.

11.1.1 View an Existing Scenario Analysis

You can view a previously generated scenario analysis by inquiring through the identification code,

To view an existing scenario analysis

- Click Origination > Origination > Scenario Analysis. The Scenario Analysis screen is displayed in the main window.

- Either specify the identification code of a previously generated scenario analysis in the Inquiry Id field, or select the identification code from the adjacent drop-down list.

- Click Show Details.

11.1.2 Generating Scenario Analysis

To generate a scenario analysis

- Click Origination > Origination > Scenario Analysis.

The Scenario Analysis screen is displayed in the main window.

Click Add and complete the following Parameters:

You can click Initialize to clear (or ‘refresh’) the screen

details at any time.

Field |

Do this: |

Inquiry Id |

View the inquiry identification code. |

Application # |

View the application number. |

First Name |

Specify the first name of the applicant. |

Last Name |

Specify the last name of the applicant. |

Phone |

Specify the phone number of the applicant. |

Specify the email address of the applicant. |

|

Company |

Select the company. |

Branch |

Select the branch. |

Product |

Select the product. |

Producer Type |

Select the producer type associated with the product. |

Producer Name |

Select the producer associated with the product. |

Producer Contact Number |

View the producer contact number. |

Region |

View the region where the producer belongs. |

Territory |

View the territory where the producer belongs. |

Requested Amt |

Specify the requested advance amount. |

Term |

Specify the requested term (number of payments). |

State |

Select the state code. |

Asset Type |

Select the asset type. |

Asset Sub type |

Select the asset sub type. |

Make |

Specify the make of the vehicle. |

Model |

Specify the model of the vehicle. |

Promotion |

Select the requested promotion. |

Billing Cycle |

Select the billing cycle schedule. |

Instrument |

Select the instrument. |

- In the Loan Calculator section, you can specify the details

of various Parameters, Repayment Options, and Amortization Schedule.

For detailed field information, refer to Loan Calculator section in Tools Chapter. - After you have specified all the required details, click Calculate.The system computes the standard payments with the details specified.

- Click Save And Stay or any other required save option. For more details on save options, refer to ‘Basic Actions’ section in Navigation chapter.

The system auto assigns an identification code to your calculations on the Scenario Analysis screen.

11.1.3 Auto Suggest Pricing for the Scenario Analysis

The Scenario Analysis screen provides an option to calculate and display the Pricing based on previously generated scenario analysis details.

- In the Scenario Analysis section, specify the required information to generate scenario analysis and save the details. (Refer section Generating Scenario Analysis).

- click Suggest. The system displays the Pricing details.

11.1.4 Creating an Amortized Schedule for the Scenario Analysis

You can create the amortized schedule for the selected scenario analysis, The system computes the and displays the amortized schedule under Amortization Schedule tab

To create an amortized schedule for the scenario analysis

- Specify the required information to generate scenario analysis. (Refer section Generating Scenario Analysis)

- Click Amortization Schedule tab and then click Amortize.

The system uses the calculated payment data to complete the Amortization Schedule section and displays the following information:

Field |

View this: |

Seq |

Payment number. |

Pmt Dt |

Payment date. |

Pmt Amt |

Payment amount. |

Principal Amt |

Component of the payment amount allocated towards reduction of the principal balance. |

Interest Amt |

Component of the payment amount allocated towards reduction of the interest balance. |

Balance Amt |

Remaining principal balance. |

11.1.5 Creating an Application from the Scenario Analysis

To create an application from the scenario analysis

- Specify the required information to generate scenario analysis. (Refer section Generating Scenario Analysis)

- Click Create App.

11.1.6 Generating a quote from the scenario analysis

You can generate a summarised report using the calculated details in the format of quote.

After you have specified all the required information to generate scenario analysis, (Refer section Generating Scenario Analysis), click Print Quote.

For detailed information, refer to Printing a Quote section in Tools chapter.

11.2 Viewing Information from Scenario Analysis

The system assigns the information on the Scenario Analysis screen an application number. You can open this application on the Application Entry screen and view information from the Scenario Analysis screen at the following locations:

- The Application screen

- The Request tab

- The Collateral tab

- Underwriting

In the Underwriting screen, the Decision link’s Pricing and Approved sections display the details from the Scenario Analysis screen. You can modify the price chosen in the Scenario Analysis screen and re-price the application. If application has been repriced, the comments regarding the multiple offers on the Comment screen should be manually updated before approving the application.

11.3 Subvention Sub Tab

In the Subvention sub tab you can review the subvention information from the application entry and calculate the subvention amount, as well as override the calculated subvention amount. The participant’s information is automatically populated based on the selected subvention plan.

The calculated Subvention details of the application created from Scenario Analysis is populated to Origination > Request > Subvention tab.

To complete the Subvention sub screen

- Click Origination > Origination > Scenario Analysis > Subvention sub tab.

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Subvention Plan section: |

|

Plan |

Select the subvention plan. |

Description |

View the subvention plan description. |

Sub Plan Code |

Select the sub plan code from the drop-down list. |

Sub Plan Description |

View the subvention sub plan description. |

Subvention Type |

View the subvention type. |

Include |

Check this box to include this record in calculations on the Other Details sub section |

- Perform any of the Basic Actions mentioned in Navigation chapter.

11.4 Compensation Sub Tab

The Compensation (Loan) sub tab records and displays the terms of compensation between the finance company and the dealer for Loan transactions.

Note the following:

- The computations in the Compensation sub tab refers to the 'Requested Amt' in Scenario Analysis tab.

- The 'Buy Rate' is referred from selected ‘Pricing’ definition in Scenario Analysis section.

- The 'Request Rate' is referred from the ‘Rate from' field of selected 'Pricing' definition in Scenario analysis section.

The calculated Compensation details of the application created from Scenario Analysis is populated to Origination > Underwriting >Decision tab.

To complete the Compensation (Loan) sub screen

- Click Origination > Origination > Scenario Analysis > Compensation sub tab. System load the compensation plan details.

Note that, the compensation plan will use application information to calculate compensation.

The system loads the following information on the Compensation sub screen:

Field: |

Do this: |

Compensation section |

|

Compensation Plan |

View the compensation plan. |

Disbursement Method |

View the compensation payment method. |

Calculation Method |

View the compensation calculation method. |

Chargeback section |

|

Paid Calc Method |

View the charge back calculation method (early payoff). |

Paid % |

View the charge back percentage (early payoff). |

Paid Basis |

View the charge back basis (early payoff). |

Paid Term |

View the charge back term (early payoff). |

Paid Days |

View the charge back days (early payoff). |

Chg Off Calc Method |

View the charge back calculation method (charge off). |

Charge Off% |

View the charge back percentage (charge off). |

Chg Off Basis |

View the charge back basis (charge off). |

Chg off Term |

View the charge back term (charge off). |

Chg off Days |

View the charge back days (charge off). |

Calculation section |

|

Spread Formula |

View the compensation spread formula. |

Buy Rate |

View the approved buy rate. |

Factor |

View the compensation factor. |

Addl Factor |

View the additional compensation factor. |

Max Spread % |

View the maximum spread or percent allowed. |

Upfront % |

View the upfront compensation percentage. |

Flat Amt |

View the flat amount. |

Upfront Comp Amt |

View the compensation amount paid upfront. |

Rem Comp Amt |

View the compensation amount remaining. |

Comp Amt |

View the compensation amount. |

- Perform any of the Basic Actions mentioned in Navigation chapter.